MultiCash Communication Platform

Provide a Central Touchpoint to the Bank’s Payment and Transaction Services

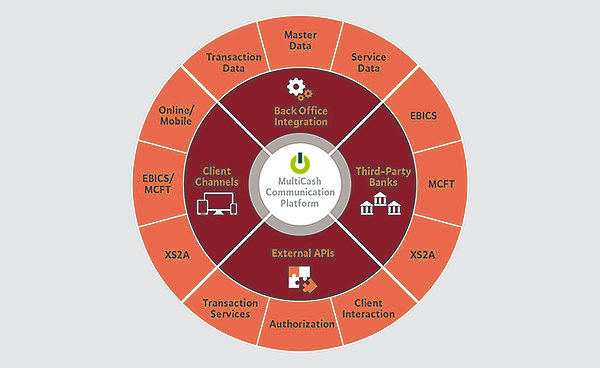

For banks and banking groups needing a modern, highly user-friendly way to deliver transaction banking services to their corporate clients, either nationally or across multiple countries, the MultiCash Communication Platform is the solution. It can be flexibly adapted to different customer requirements and is therefore suitable for small and medium-sized enterprises as well as for large corporates. Set up a central digital touchpoint where clients can access the bank via a range of channels and devices. Tailor your package to the specific services of your bank and use your own branding, based on the open design. Prepare and customize reports with the in-built report designer and use advanced Data Analytics for tracking user behaviour patterns and payment traffic.

Fully integrated in the bank’s system landscape, the solution can be used to deliver bulk transaction and real-time services to one or more customer segments, validate user rights at a granular level and deliver services by multiple channels. Join the worldwide community of over 250 banks and service providers who value the flexibility and forward-looking approach. The solution is constantly updated to comply with the latest technological and regulatory requirements and extended as needed to meet changing expectations. This focus on market needs is also reflected in the wide range of transaction formats and the large number of languages supported.

A solution for all needs - the Omni-Channel approach

Banking clients today expect quick and easy access to all the services they need, whenever they need them and however they want them, at any time and regardless of the access channel. The omni-channel design of the MultiCash Communication Platform makes it a perfect fit. Users can connect via a range of possible e-channels and devices, at the same time if necessary:

- The powerful MultiCash On corporate banking suite provides a rich range of services, accessible by browser or mobile app.

- For corporates asking for a closer integration with their accounting/ERP system, many banks provide a standardized secure file-transfer channel (EBICS or MCFT), options which are widespread in Europe and which Omikron helped to launch and pioneer.

- For users attracted to the services of FinTechs and other Third-Party Providers, a PSD2-compliant Open Banking API based on the Berlin Group standard is integrated in the platform, as well.

At the same time, the platform retains the fully modular structure which is highly valued by many banks and ensures that the system can be implemented quickly and easily. Often the solution is used for a specific purpose, e.g. to act as an EBICS-Gateway for corporate clients using this open standard within an ERP, E-Banking or Payment Factory application. The bank can then build out the platform to support further channels or functions, as and when required by the market.

Open Design – Control your Digital Strategy

Be sure of meeting client expectations in today’s dynamic business environment by opting for an open banking design. The MultiCash Communication Platform provides flexibility at all levels. First of all, the platform allows the bank to provide its own set of APIs, which may include publicly available services, such as an Access-to-Accounts interface or other bank-specific services (for instance from a Trade or Factoring platform). Secondly, the communication platform has a facility for integrating services from other specialist providers. Examples which immediately add value include external data feeds, such as online exchange rates or maps with branch locator and customer interaction services such as a Chat or Video-Identity function. As the entire set of client functions has been developed as a series of web service APIs, you as a bank are able to integrate all or parts of the functionality within your own portal, in your own look and feel. This supports a “best of breed” approach, when you integrate targeted solutions from leading providers, alongside in-house developments.

Seamless Workflows for Transaction Banking

The platform enables a smooth exchange of data between the partners involved, as the access channels to the customers can be seamlessly integrated into the bank's systems. A workflow manager ensures that the data is transferred securely and efficiently to the right destination. Alongside that, the Communication Platform provides a set of tools and options which have been designed to support the smooth interaction with back office systems. A Transaction Data Connector allows data of all kinds to be exchanged in real-time with one or more banking systems. Users can in this way easily submit urgent high-value transfers, make Instant Payments, check their financial status or block their credit card – to cite just a few examples. A Service Data Connector supports the exchange of freely configurable information, allowing the bank to define order forms and reports to match the services it can provide. To avoid unnecessary redundancy, a Master Data Connector synchronizes all core data with the core banking system.

Innovation & Experience – A Guarantee for Future-proof Investment

The MultiCash Communication Platform represents the latest generation of Omikron’s established e-banking platform, which is already successfully established worldwide. A major factor behind the success of this solution has been its continuous development, which will continue to be an essential cornerstone of the product strategy in the future. Users who already work with the platform can be sure of a smooth, seamless migration transition to the new version when they update (even if fundamental changes have been made). New users can be confident of investing in a future-oriented system built on robust and proven components and functions. At the same time, the communication platform ensures a smooth and transparent migration from legacy systems, with minimum impact on bank systems and clients. Use of the latest technology ensures optimal data storage and highest performance levels, particularly for large volumes of data which are especially important in corporate business.

Certified by an independent specialist IT security organisation (the German-based TÜV Saarland), the security architecture incorporates encryption at all stages in the workflow: within the platform, during all connections to external systems and for all client e-channels. The internal design ensures that users have no access to files or databases at any time, eliminating the risk of misuse or manipulation. Within the application, a granular set of user profiles ensures that each user will access only the options which he/she needs for daily tasks, view and work with only information for which he/she has rights and have no access to data or functions for which he/she is not authorised.

Your Benefits with the MultiCash Communication Platform at a glance:

- Custom-tailored e-banking solution for your corporate customers, by means of the modular, expandable and scalable architecture

- Central touchpoint for multiple channels, devices and apps, based on the omni-channel design

- Open Banking interface allowing additional functions and innovative solutions to be integrated

- High efficiency and reach of real-time services through their seamless integration

- Powerful Transaction Banking services for handling high volumes of data

- Optimized data protection due to compliance with the latest security standards and audit requirements