MultiCash Transfer AutoClient – Optimized Bank Connectivity

Automated interaction and Host-to-Host communication for corporates

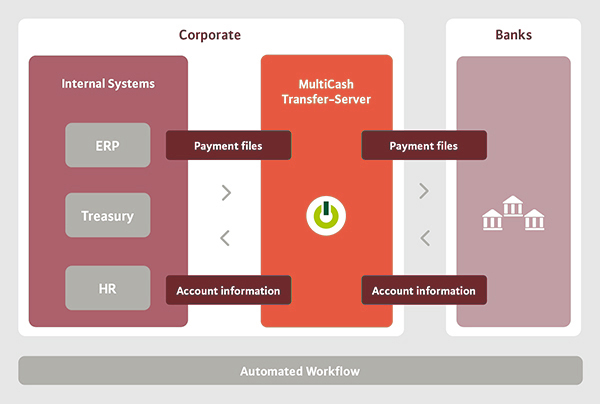

Many corporates are looking to automate the workflows between their internal ERP / accounting systems and their banks. Nowadays, many tasks previously managed using e-banking tools require no manual intervention from the user. In particular, regular payment runs and bulk direct debit collections are generated and often signed within the internal systems. In this case a timer-driven solution for forwarding the files to the relevant bank(s) is needed. The regular collection of balance and transaction information is another workflow which can be fully automated. Designed as a central hub for transactional business, MultiCash Transfer AutoClient is tailor-made for these requirements. An increasing number of banks are including MultiCash Transfer AutoClient within their solution portfolio, as a corporate connectivity or Host-to-Host tool.

Within MultiCash Transfer AutoClient, communication jobs can be set up. The order type for each job and the frequency is also pre-defined – this can in a defined range (daily, weekly etc.) or event-driven. For submitting transactions to the bank(s), routing rules can also be defined – using specified information, e.g. the file name and file content (bank code, account number). MultiCash Transfer AutoClient detects the appropriate routing rule and automatically triggers communication to the bank. By default, the transfer of payment files to the bank is secured using an automated digital signature (“transport signature” or “corporate seal”). If company policy requires a manual approval and/or personal signature by authorized individuals, these can be made using the integrated File Manager (browser or Windows-based).

Your Benefits with MultiCash Transfer AutoClient at a glance:

- Secure and automated solution to meet the needs of a specific corporate customer segment for a simple and smooth connection to ERP systems

- Comprehensive protection against manipulation by guaranteeing integrity, authenticity and confidentiality at all levels

- Fulfilment of customer expectations for a sound investment, as the integrated communication standards MCFT and EBICS are constantly maintained to comply with the latest new security standards and technologies

- Powerful solution for high data throughput and extensive processing, including parallel operation of multiple communication channels and extensive scalability