Liquidity module

How much cash do I have?

To answer this question, the following sub questions are relevant:

- In what currencies is my cash denominated?

- Where is it located?

- To what extent are yesterday’s expected cash flows incorporated?

- What is my expected end of day cash position?

- What is the outlook for the next 13 weeks?

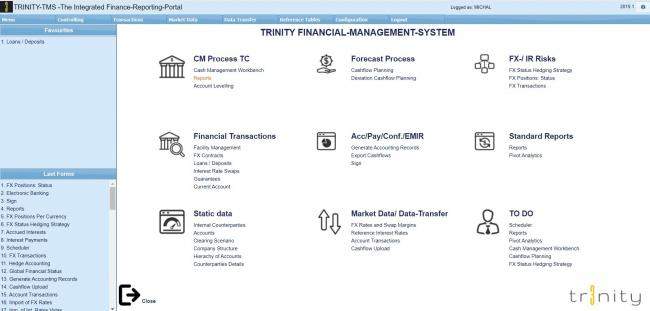

The Liquidity Management module of the TRINITY TMS will help you to get this information in a streamlined way.

The Liquidity Management module builds on the basic module, which solves the requirements of a modern treasurer necessary for managing daily cash as well as medium-term and long-term liquidity. Subsidiaries or foreign affiliates create daily cash reports by uploading their (electronic) account statements.

Subsequently, when cash positions (in different currencies) have been determined and all treasury cash flows have been reconciled, the cash manager can make decisions supported by the actual situation and make payments processed by a modern banking system.

Once all day-to-day activities have been resolved, the department and its affiliates, if any, can focus on forecasting effective cash flow through this module. Cash-flow forecasts in any world currency can be uploaded via an Excel file, through the ERP system or entered manually.

At the headquarters level, individual cash-flow forecasts are then consolidated with a single mouse click, so data can be viewed and analyzed in a very flexible way.

This module is also often used as a basis for determining FX exposure.

Liquidity-Management:

- Cash-Management

- Import bank statements MT940

- Cash Flow Forecast by bank account

- Reconciliation (Expected/Actual)

- Actual data identification with cash flow rules

- Account clearing

- Cash Management reporting

- Cash flow forecasting

- Currency differentiated cash flow forecast (flexible time buckets)

- Comparison / Analysis of delta (forecasts-actual or forecast-budget)

- Scenario Analysis