Back Office Integration – Smooth integration in the bank’s infrastructure

Flexible Workflow Management

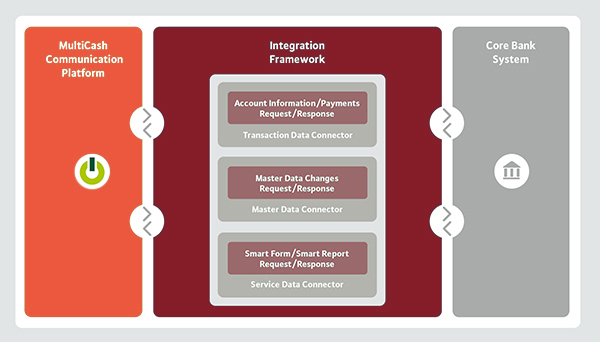

Today, corporates and banks both expect the delivery of banking services to be based on a close connection of the e-banking application with the core banking system. With Omikron’s flexible Integration Framework, you can be sure that the workflows can be configured optimally to suit the type of business. First of all, a workflow manager ensures that the data is transferred securely and efficiently to the right destination. Additional capabilities support the efficient exchange of different types of data.

Efficient transaction throughput

For transactions, two options are usually operated in parallel:

- A loose coupling in the form of a file-based interface remains useful and efficient for the exchange of large files (e.g. bulk payments).

- There is an increasing demand for real-time services, for instance to obtain check the current balances/financial status or submit Instant Payments. These can be realized using the Transaction Data Connector. This interface consists of a standardized MQ-based connector via which XML messages are exchanged. If necessary, a bank-specific adapter can be implemented to match the concrete interfaces of the specific core banking system.

Intelligent format analysis and conversion of payments with UBIQCash

As part of the process to increase the levels of automation in payments business, UBIQCash can be used. This universal payment generator provides intelligent format analysis alongside format conversion. The application was designed specifically for cross-border payments, where often a number of file formats are needed, and the formats required by the banks differ from the original formats. Frequently, corporate accounting and payment systems deliver a single central format, which UBIQCash then converts to the outgoing formats needed. In other cases, UBIQCash can be configured as a universal “format converter” for multiple in-bound and outbound formats.

Extendable service management

For information exchange, especially in the online banking context, the Service Data Connector supports the exchange of freely configurable information, allowing the bank to define order forms and reports to match the services it can provide, based on generic XML messages.

Harmonization of customer and user details

To avoid unnecessary redundancy, it is also possible to synchronise the master data with the core banking system. This option is supported by the Master Data Connector. Again, this interface consists of a standardized MQ-based connector for exchanging XML messages, enhanced by a bank-specific adapter if necessary. Either the back-office system or the MultiCash Communication Platform can be defined as the lead system and an in-built feature ensures that changes to master data in the lead system are immediately mirrored to the second system.

Specialist service – Automated Bundesbank Connection

Within the framework of the Deutsche Bundesbank’s Electronic Access (EÖ), banks and authorized corporates can manage their Bundesbank accounts electronically, collect statements and submit payments. An automated communication tool, MultiCash Transfer, can be implemented in the workflows to handle this exchange. Payment files and messages are received from the Bundesbank and immediately passed on to the client’s accounting package and / or Treasury Management package. In the same way, payment files generated by the accounting system are imported using an automated file interface and submitted to the Bundesbank. An on-screen report of all files received from or submitted to the Bundesbank is available, and full details of each file can also be consulted. The easy-to-operate administration functions enable the user to configure the system according to his individual needs.

Your Benefits with the Back Office Integration Framework at a glance:

- Standardized and well documented toolset, allowing efficient interfaces to be built quickly

- Optimize the services provided by using file-based and real-time interactions depending on the type of business

- Avoid data redundancy by using one main source for master data